What’s Real estate Trust Beneficial Interest

- The legal basis for the beneficial rights of real estate trusts is the Trust Law promulgated in 1922. Real estate trust beneficial interest is also called TBI.

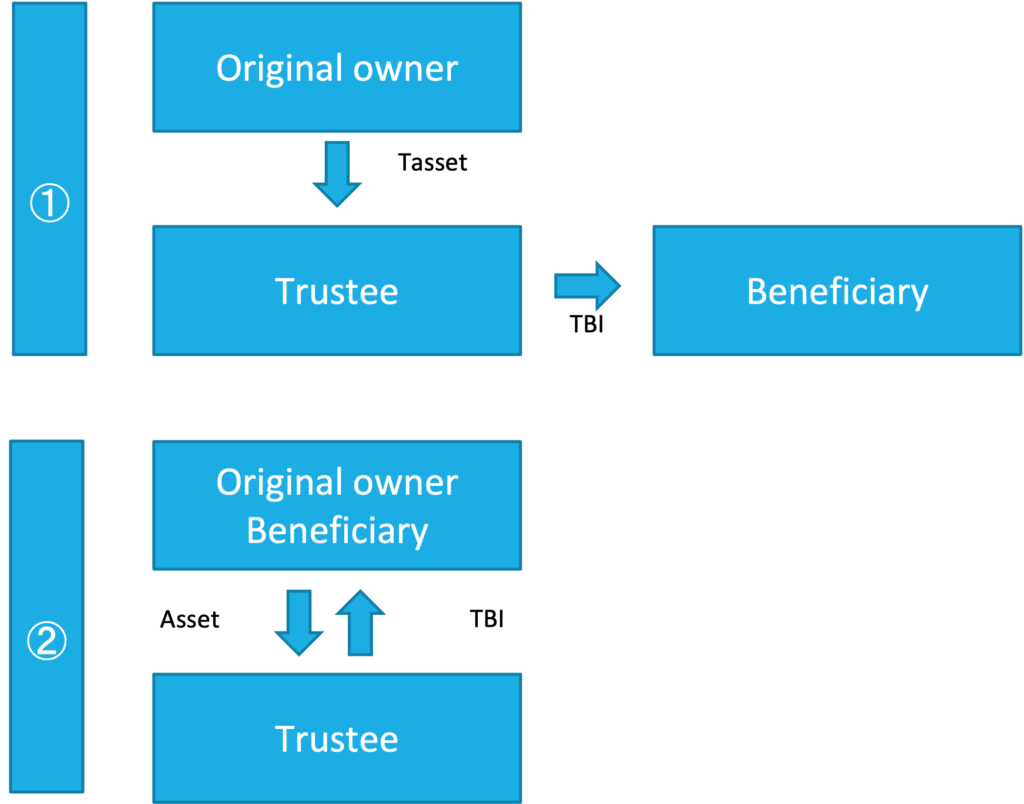

- In the trust structure, the relationship between the original owner, the trustee and the beneficiary is as follows.

- The trustee is the legal owner of the trust asset. In Japan, only trust banks or trust companies licensed by the Finance Department can become trustees.

- Beneficiaries are entitled to the economic benefits of trust assets.

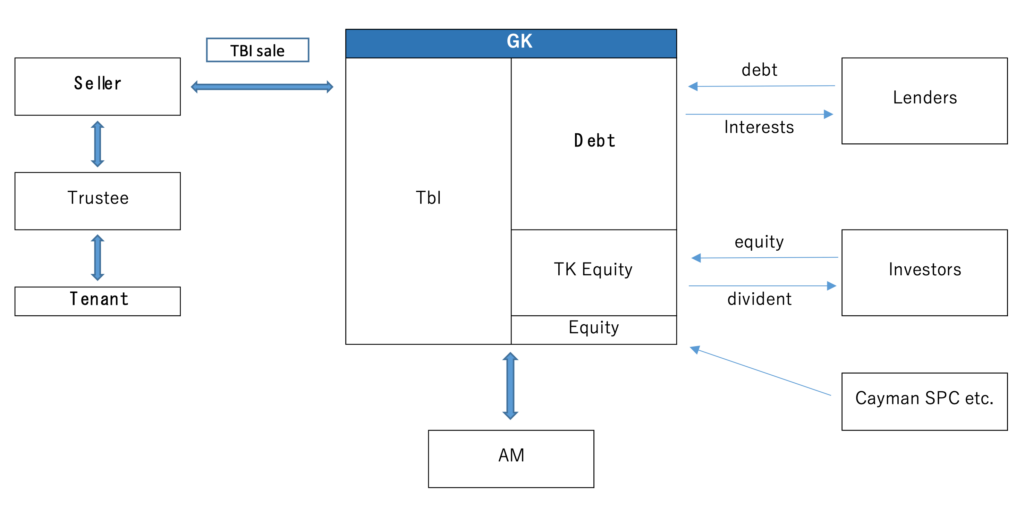

TK-GK

Avoiding double taxation:If the TK arrangement qualified, the GK is permitted to deduct distributions to the investor from its taxable profits in addition to deducting debt payments.

TK is the equity investor and GK is the operator. They joins a partnership agreement. The TK should be a Silent Partnership。

A TK arrangement qualifies for favorable tax treatment if the TK investor is a passive investor with minimal control over the management of the GK and the contributed funds under the arrangement.

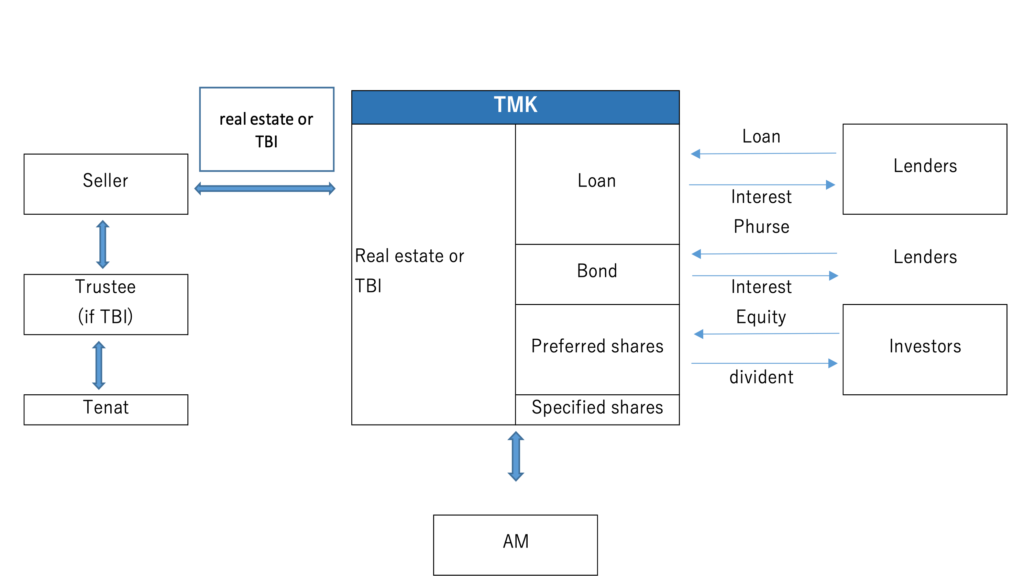

TMK

Avoiding double taxation:If the TMK meets certain requirements under the Tax Code, it is permitted to deduct distributions to the preferred shareholders from its taxable profits in addition to deducting debt payments.

A TMK incorporated under the Asset Liquidation Law (ALL) is another type of corporate entity often used as a real estate investment vehicle.

This entity may only be used to liquidate or securities certain assets.

This investment platform is used to make investments in real estate, trust beneficial interests in real estate, and loans and TMK bonds that are backed by real estate.

A TMK is typically funded by issuing TMK bonds and preferred shares that meet certain tax qualifications required for the preferential tax treatment of the TMK.